WHAT ARE REAL ESTATE CAP RATES AND HOW TO EASILY THUMB-NAIL A MULTI FAMILY CAP RATE CALCULATION

One of my students in Los Angeles reached out to me the other day. I have been coaching him since the recession back in 2008 or so. At that time, I pushed him HARD to get into the multi-family real estate game because the CAP RATES WERE (past tense) amazing. Fast FWD to 2018 – the cap rates suck. Will they go down further and may you be able to sell to the “Greater Fool”? YES! It very well may happen. I do not have a crystal ball. But what I DO, is play conservative and invest for YIELD. GROUP HOME CAP RATES are HUGE…..READ ON!

Although it is a bit more work than class A or class B; the yields (CAP RATES) and opportunities were very lucrative in the C and D grade space back then. He had the capital, the time and the energy to build up a strong portfolio – although he opted NOT to get into the Group Home game as he didn’t feel like he had the management experience at the time or the personnel resources available to act as house managers.

At the time, he was buying stuff for $60 – $80 per square foot in downtown LA. Heck, even back then the build-costs were upwards of $200. I figure his buy-in cash yield (cap rate) at the time was 9-11%…To give you an idea, nowadays, people are buying stuff in Inglewood and elsewhere out there in the mid 3%’s (although they are probably marketing them as 5%’s)

Today I want to give you a quick tip on how to easily compute a cap rate (or yield) on your total investment and then also give you an idea of what type of return you can generate if you set up a group home

Subscribe

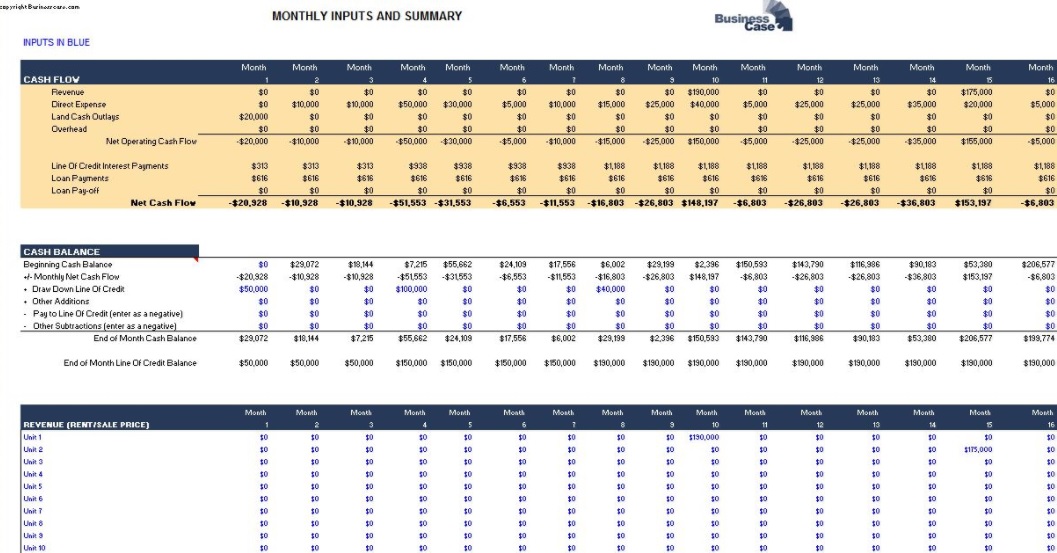

Step 1: Determine total annual revenues (tip: take monthly gross rents X 12)

Step 2: Divide by 2

Step 3: Take that number and divide by your all-in cost (purchase price + repairs + fees)

EXAMPLE:

Revenues are $100,000 per year. Divide by 2 = $50,000. Your all in costs are $1,000,000.

$50,000 / $1,000,000 = 5%

That is your return or CAP rate

Those types of returns are pretty typical in non-tier 1 markets (assuming tier 1 = San Fran, LA, NYC etc) for C grade properties. As you can imagine, it will take A LONG TIME to get your money back and get rich this way (unless you plan to fix and flip or add value in some capacity)

As Warren Buffet says, “If you need a calculator to determine your return….chances are it is not a good deal!”

SUMMARY

When you operate group homes, you are operating a business. Most small businesses should enjoy 20-35% returns.– REMEMBER, these can be calculated using the cap rate formula I taught you above. Often times even more. With Group Homes, you should be able to generate 1000% returns (not including the real estate) which should bring your net ROI / CAP RATE / YIELD of your group home and the real estate to anywhere between 20% – 40% depending on your location.

Stay Strong,

Andy