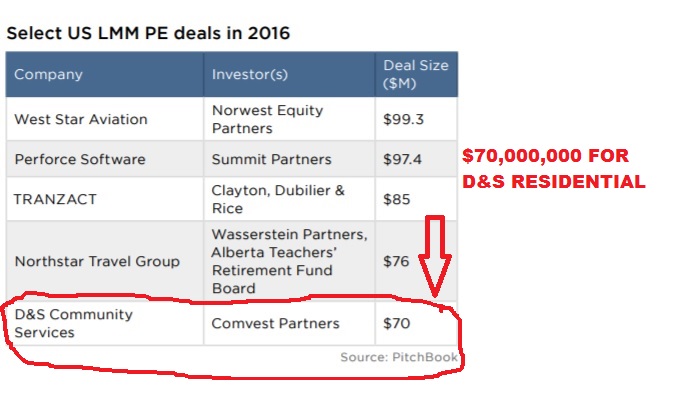

What is Your Excuse For Not Starting a Group Home??

What is Your Excuse For Not Starting a Group Home?? We talk to a LOT of people about Group Homes and do you know what the #1 excuse for people not starting up their dream business is? Budget Restraints! That’s right: Lack of funds If this is YOUR reason for not starting up your own … What is Your Excuse For Not Starting a Group Home??